A significant fiscal adjustment that could reshape investment returns in Nigeria is on the horizon, according to a major economic forecast. Veriv Africa, a leading data insight and research advisory firm, has projected a potential tripling of the Capital Gains Tax (CGT) rate from the current 10% to 30% in 2026. This projection is part of a broader wave of fiscal shifts detailed in the firm’s “2026 Nigeria Macroeconomic Outlook” report, entitled “Pursuing Growth Amidst Uncertainties.”

The report, presented to stakeholders in Abuja, serves as a forward-looking, data-driven guide for policymakers, investors, and business leaders navigating Nigeria’s complex economic reforms. It paints a picture of a dual-track economy: a resiliently climbing non-oil sector contrasted against profound policy changes designed to boost government revenue.

Understanding the Capital Gains Tax (CGT) and the Potential Impact

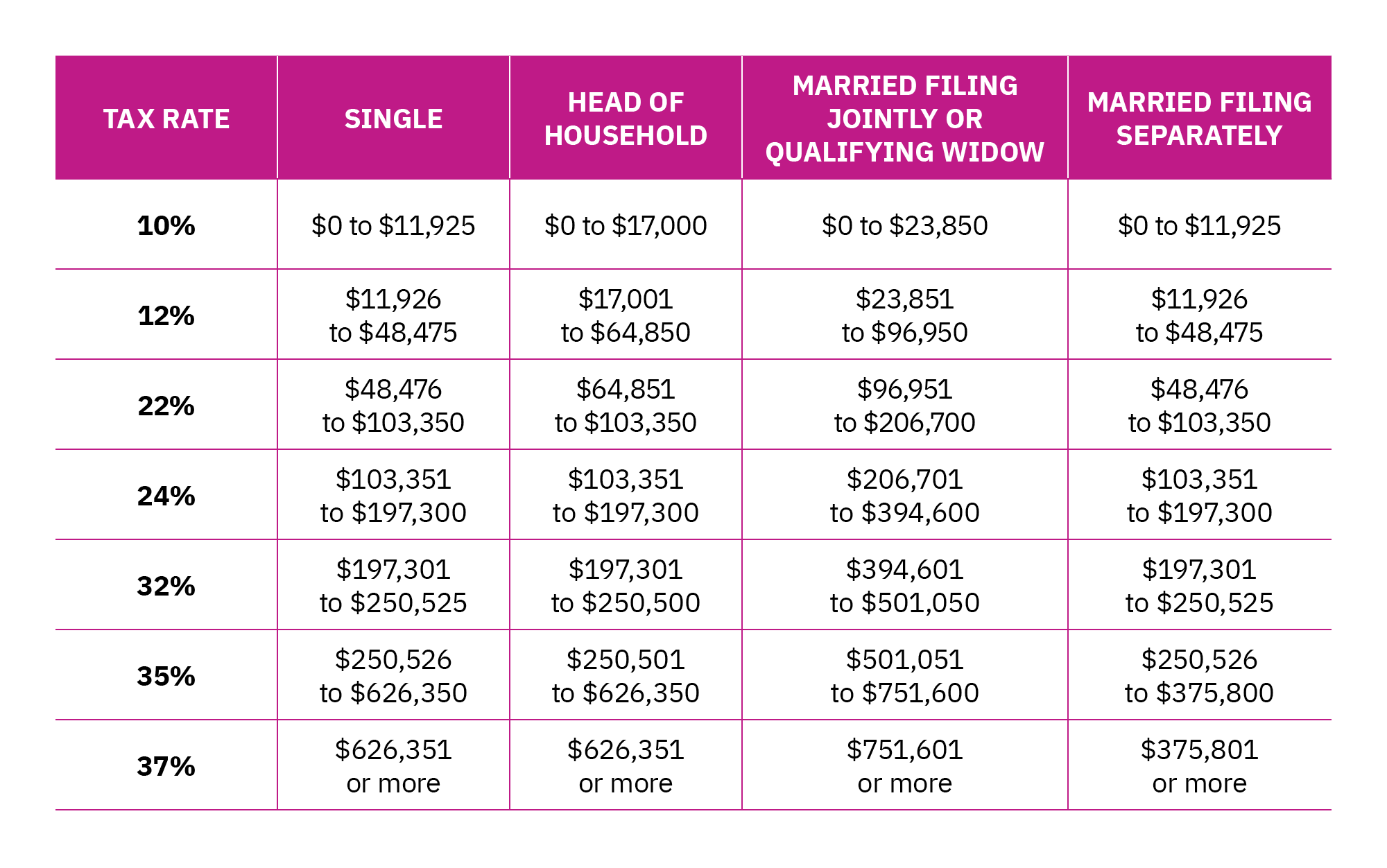

Capital Gains Tax is levied on the profit made from the sale of an asset—such as stocks, bonds, or real estate—where the selling price exceeds the purchase price. A jump from 10% to 30% represents one of the most substantial increases in this tax category in recent memory. For context, this would significantly alter the post-tax return calculus for both local and foreign investors.

Practical Example: An investor who buys shares for ₦5 million and later sells them for ₦8 million realizes a gain of ₦3 million. At the current 10% CGT rate, the tax liability is ₦300,000. If the rate rises to 30%, the tax on the same gain would be ₦900,000—a ₦600,000 increase that directly reduces the investor’s net profit by two-thirds. This could influence decisions on holding periods, asset allocation, and market entry/exit timing.

Broader Economic Context from the Veriv Africa Report

The projected CGT hike is not an isolated event but part of a comprehensive fiscal strategy. Ms. Omotayo Faro, a Managing Director at Veriv Africa, emphasized that the report aims to equip decision-makers to “anticipate change rather than merely reacting to it.” The analysis synthesizes critical signals shaping Nigeria’s trajectory, including:

- Exchange Rate Stabilisation: The Naira is expected to navigate a new corridor between ₦1,450 and ₦1,650 to the US dollar, suggesting targeted interventions to reduce volatility.

- Energy Transition: Decentralised energy systems are identified as the next frontier for private capital, highlighting opportunities in solar and gas-powered mini-grids.

- Sectoral Projections: The report provides specific analyses for agriculture, manufacturing, and services, assessing how policy reforms will impact growth and employment.

Strategic Implications for Investors and Businesses

This projected policy shift necessitates proactive planning. Stakeholders should consider:

- Portfolio Review: Evaluating asset holdings to understand potential tax exposure on unrealized gains before 2026.

- Investment Horizon: A higher CGT may incentivize longer-term holdings to defer tax liability or seek qualifying exemptions.

- Channeling Capital: With decentralised energy flagged as a growth area, investors may pivot towards sectors that align with both policy incentives and sustainable returns.

The full “2026 Nigeria Macroeconomic Outlook” report, which provides deeper dives into these regulatory pivots and structural changes, is available for detailed study on the Veriv Africa website. As Nigeria pursues growth amidst global and domestic uncertainties, understanding these data-driven projections is crucial for strategic resilience and informed capital allocation.

Source: Veriv Africa 2026 Macroeconomic Outlook, as reported by the News Agency of Nigeria (NAN). Edited by Benson Ezugwu/Bashir Rabe Mani.