Lagos, Nigeria – The Amalgamated Union of App-Based Transporters of Nigeria (AUATON), the primary union representing e-hailing drivers, has raised a critical alarm over what it terms an opaque and burdensome policy of double Value-Added Tax (VAT) deductions imposed on drivers using the inDrive platform. This development highlights a growing tension between gig economy workers, platform operators, and tax authorities in Nigeria’s rapidly evolving digital transport sector.

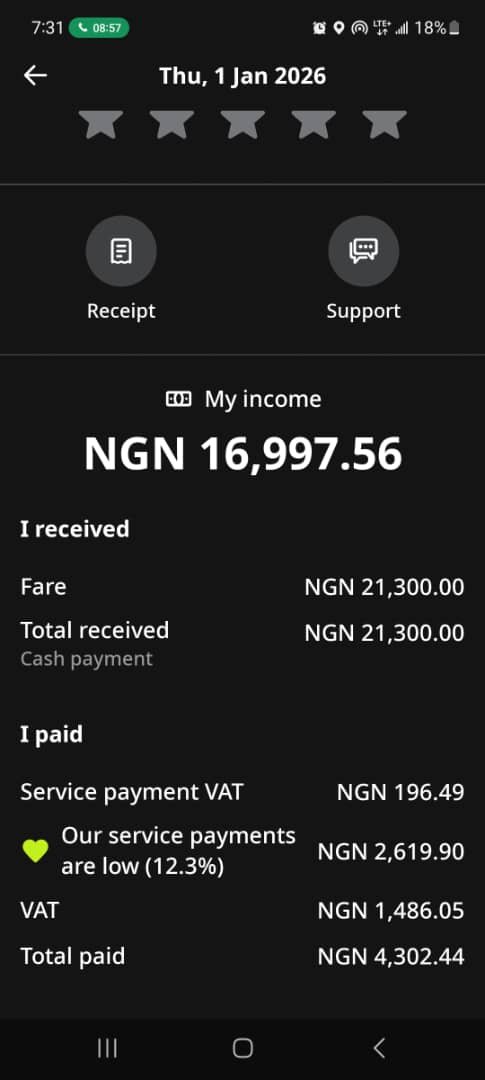

According to Mr. Kolawole Aina, Vice-President of AUATON for the South West, drivers discovered the new deduction regime on January 1, 2026. Their invoices now show two separate VAT charges: one explicitly labeled as a “service payment VAT” and another simply termed “VAT.” This dual charge has effectively increased the total commission and tax deduction on the inDrive platform from approximately 9.99% to about 12.5% per ride—a significant jump in operational costs for drivers already grappling with thin profit margins.

“Our inDrive members were ushered into the New Year with what we can only term an excessive tax burden,” Aina stated in an interview with the News Agency of Nigeria (NAN). “This double taxation is unsustainable. We have been complaining that our earnings are not enough, and now we are being charged additional expenses.”

Context: The VAT Landscape for Digital Platforms in Nigeria

To understand the union’s frustration, it’s essential to recognize the complex VAT framework governing digital services. In Nigeria, VAT is a consumption tax administered by the Federal Inland Revenue Service (FIRS), typically at a rate of 7.5%. Digital platforms like inDrive are legally required to collect and remit this tax on behalf of the government for services rendered. However, the emergence of a second, ambiguously named “service payment VAT” raises critical questions:

- Is this a new state-level levy, perhaps from the Lagos State Government, which has been aggressive in expanding its tax net?

- Could it be a platform fee mislabeled as a tax, effectively passing operational costs to drivers under the guise of government mandate?

- Is it a case of poor communication where a single tax is being itemized confusingly into two components?

Aina noted the union’s suspicion that the tax was imposed “by either the Lagos State Government or the Federal Government in collaboration with the app company,” but the lack of transparency is the core issue.

A Systemic Problem: Exclusion from Policy Dialogue

The union’s grievance extends beyond the financial impact to a fundamental flaw in governance. Aina decried the pattern where “app companies and government arrive at decisions in their meetings and do not communicate those decisions to the drivers who are affected.” This lack of inclusion creates policy shock and erodes trust. When drivers—the primary stakeholders and revenue generators—are excluded from discussions that directly affect their livelihoods, policies are more likely to be met with resistance and fail.

“Meetings between app companies and government should also include the representatives of drivers,” Aina emphasized. This call for a tripartite dialogue (Government-Platform-Worker) is a global best practice for managing the gig economy and preventing exploitative or unclear policies.

Practical Impact and Platform Silence

The mechanics of the deduction make it non-negotiable for drivers. Aina explained that if a driver does not pay the double tax on a completed trip, the system blocks them from picking up the next ride. This enforcement mechanism leaves drivers with no choice but to absorb the cost, directly cutting into their daily take-home pay.

Compounding the problem is the alleged inaccessibility of inDrive. The union claims the company is unresponsive to calls and messages, potentially using changed contact details. Furthermore, the platform’s reported policy of only responding to individual enquiries, not associations, undermines collective bargaining and violates the principle of freedom of association—a right crucial for vulnerable gig workers.

Broader Implications and a Call for Equity

Aina pointed out a perceived inequity in the tax application: “To our knowledge, this tax does not affect other categories of transport operators such as the flag-down taxis, park-based drivers and other transporters.” This selective enforcement on app-based drivers risks creating an unlevel playing field and could be seen as penalizing formalization and digital record-keeping inherent to platform work.

The union’s appeal also connected this issue to broader national policies, urging the federal government to include its members in initiatives like the Compressed Natural Gas (CNG) conversion program for transporters. This highlights a desire for holistic support, not just relief from sudden tax burdens.

Conclusion: A Need for Clarity, Inclusion, and Fairness

The situation facing inDrive drivers is more than a billing anomaly; it is a symptom of the growing pains in regulating the digital economy. It underscores the urgent need for:

- Transparent Communication: inDrive must immediately clarify the nature and authority behind both VAT charges to its driver-partners.

- Inclusive Policymaking: Tax authorities and platform companies must engage worker associations like AUATON in dialogue before implementing new fiscal measures.

- Regulatory Clarity: The FIRS and state tax bodies need to provide clear, public guidelines on VAT application for digital platforms to prevent confusion and potential double taxation.

Until these steps are taken, the trust deficit between drivers, platforms, and the government will only widen, threatening the stability of a sector that has become integral to urban mobility in Nigeria.

Edited by Christiana Fadare

Source: NAN News