By Taiye Olayemi, News Agency of Nigeria (NAN)

As 2025 concludes, Nigeria’s pension industry is experiencing its most transformative period since the 2004 introduction of the Contributory Pension Scheme (CPS). This phase, driven by decisive regulatory action and technological adoption, is reshaping the retirement landscape, directly impacting the financial security of millions of Nigerians.

Dubbed “Pension Revolution 2.0” by the National Pension Commission (PenCom), this comprehensive overhaul targets systemic weaknesses in governance, coverage, and operational efficiency that have lingered for years. The reforms signal a shift from merely managing funds to building a resilient, inclusive, and trustworthy social security framework.

The Catalysts: Landmark Financial and Regulatory Actions

The year’s defining moment was the Federal Government’s approval and disbursement of N758 billion to clear accumulated pension liabilities. This bond issuance was more than a financial transaction; it was a powerful signal of political will to honor long-standing obligations, restoring faith in a system where delayed entitlements had eroded confidence.

Simultaneously, regulatory enforcement entered a new era. Pension recoveries from defaulting employers surged by 180%, fueled by stronger supervisory rigor and enhanced collaboration between PenCom and agencies like the Federal Inland Revenue Service (FIRS) and the Corporate Affairs Commission (CAC). This created a tangible deterrent against non-compliance.

Direct Impact on Retirees and Contributors

For retirees, the introduction of Pension Boost 1.0 provided immediate relief, increasing monthly payouts to help cushion the effects of inflation. By mid-2025, aggregate monthly pension disbursements exceeded N14 billion, circulating crucial funds into the economy.

For active contributors, technology became a game-changer. The full automation of remittance and benefit-processing platforms has drastically reduced delays, improved transparency, and minimized human error. As Mr. Ehimeme Ohioma, a pension consultant, noted, reforms have “addressed the long-standing issue of uncredited contributions,” though reconciling historical data remains a task for operators.

Expanding the Safety Net: Inclusion and New Products

A critical pillar of Revolution 2.0 is expanding coverage beyond the formal sector. The restructuring of the Micro Pension Plan into the Personal Pension Plan aims to attract artisans, traders, and informal sector workers by offering more flexible contribution models. This is complemented by initiatives like the Pension Compliance Certificate, now a mandatory requirement for government contracts, compelling private sector compliance.

Persistent Challenges and Expert Critiques

Despite progress, significant hurdles remain. Experts interviewed by NAN highlight critical gaps:

- Governmental Compliance: Mr. Aronkola Isaac of OAU’s Pension Desk Office pointed out a stark contradiction: “Virtually all Treasury-funded MDAs are yet to fund their Retirement Savings Accounts more than six months after salaries have been paid,” violating the statutory 7-day remittance rule. This undermines the scheme’s integrity at its core.

- Diaspora Exclusion: The new PenCom enrolment application, COBRA, fails to adequately cater to retiring staff based abroad, potentially excluding a significant demographic.

- Complex Access: Processes for accessing benefits, like the 25% pension-backed mortgage facility, remain “unnecessarily cumbersome,” suggesting a need for user-centric redesign.

- Upcoming Recapitalisation: The planned increase in minimum capital requirements for PFAs by June 2027 sparks debate. While intended to strengthen capacity, Mr. Ohioma cautions that “excessive capital requirements could dilute returns on equity,” potentially affecting innovation and competitiveness.

The Road Ahead: Vision for a True Social Security System

Looking forward, experts call for more profound changes. Dr. Babatunde Raimi, a pension coach, advocates for:

- Real-Time Enforcement: Systems linking pension remittances directly to payroll and tax data to prevent defaults.

- Inflation Protection: Indexing pension payouts and reviewing contribution rates periodically to preserve purchasing power.

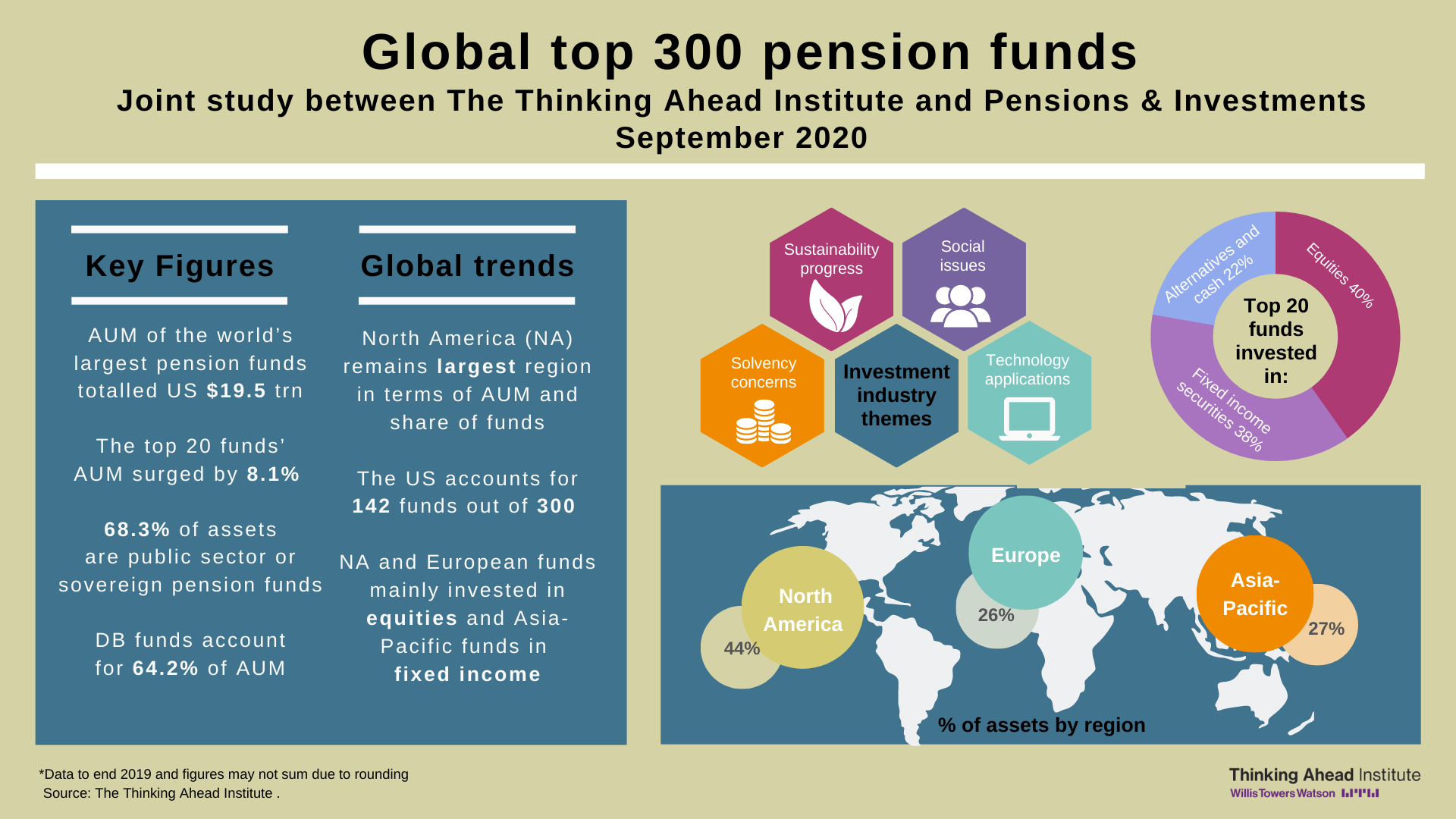

- Diversified Investments: Gradually moving pension funds beyond government securities into infrastructure and sustainable projects to generate higher long-term returns.

From the operators’ perspective, Ms. Anthonia Ifeanyi-Okoro of PenOp confirms the industry is now focused on sustainability. “The era of legacy clean-up is giving way to building a future-proof system,” she stated, highlighting ongoing efforts in stakeholder education and maintaining transparency.

Conclusion: The reforms of 2025 have undeniably strengthened the pension industry’s foundations and boosted short-term confidence. However, as the analysis reveals, true success will be measured by closing compliance gaps, ensuring inclusive design, protecting benefits from inflation, and evolving into a robust social security system that every Nigerian can trust for a dignified retirement. The momentum from Pension Revolution 2.0 must now translate into consistent execution and even bolder innovations in the years to come.

***If used, please credit the writer and the News Agency of Nigeria.***